Off Topic: Assuming Access to Data Feeds for Dozens of Futures Contracts, Can You Think of a Way to Build a Sort of Half Ass NYSE Tick?

July 27th, 2013Warning: This is not a recommendation to buy, sell or hold any financial instrument.

I had a free month of market data from IQfeed, and I found NYSE Tick (JTNT.Z on IQfeed, $TICK on TradeStation) to be pretty interesting. Displayed as a histogram, I was using it gauge extremes. Additionally, summing the (h+l+c)/3 and displaying that along with an AverageFC of it made for a pretty nifty sentiment indicator.

In the meantime, I opened an account with a futures broker that includes free realtime feeds for a lot of different futures contracts, but that’s it. No continuous symbols/no expired contract data. No NYSE Tick, for example. It’s actually incredible what I’m getting for free with this arrangement, when you look at what TradeStation or IQfeed, including CME and ICE, costs.

As of now, I’m not sure if trading the ES is any different than drunken riverboat gambling, and I’m not even willing to spend any money on the more expensive feeds to find out. I’m essentially playing around with the data and the simulator (which I can use for free with my funded futures account) to see if I can find anything interesting. Of course, the sim means pretty much nothing. All of this said, I kinda miss those NYSE Tick widgets that I coded. Looking at the list of futures that I have access to, I started to wonder if I could make something that might work like NYSE Tick out of all of this crap.

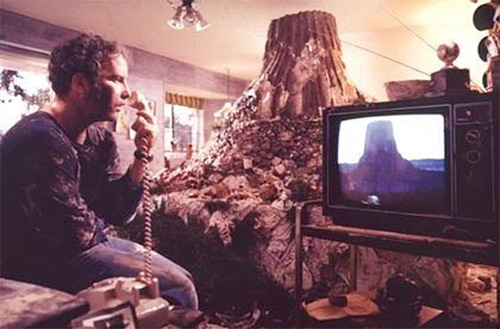

Right now, I’m looking at ES with various sizes of tick and volume bars and the 30 minute interval. Same with TF. To these, I apply yesterday’s open, high, low, close, the initial balance from the New York session, the standard pivot points and some Xaverages. It’s an effing mess, man, but the tick and volume charts are sort of like bullet time from The Matrix for when the black boxes unfurl. Instead of that time based candle wildly blinking red and green—like some sort of broken Christmas tree light—during bursts of heavy activity, you get more candles. I don’t know if anyone is just using time based bars anymore, but if you haven’t checked out tick and volume bars, they’re definitely interesting.

Do you trade the ES successfully? If you feel like reveling which other markets/indices you consider when making trading decisions, go ahead and leave a comment or email me.