Trump Seeks U.S. Military Spending Boost, Domestic Cuts

February 27th, 2017Mmm hmm.

Via: Reuters:

President Donald Trump is seeking what he called a “historic” increase in defense spending, but ran into immediate opposition from Republicans in Congress who must approve his plan and said it was not enough to meet the military’s needs.

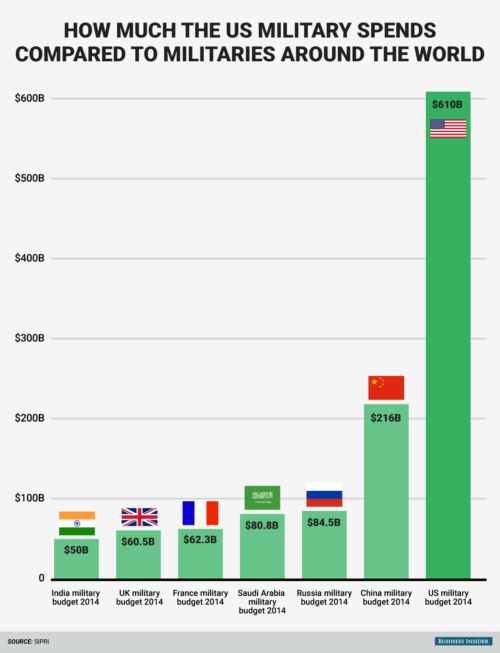

The proposed rise in the Pentagon budget to $603 billion comes as the United States has wound down major wars in Iraq and Afghanistan and remains the world’s strongest military power.

The plan came under fire from Democratic lawmakers, who said cuts being proposed to pay for the additional military spending would cripple important domestic programs such as environmental protection and education.

A White House budget official, who outlined the plan on a conference call with reporters, said the administration would propose “increasing defense by $54 billion or 10 percent.” That represents the magnitude of the increase over budget caps Congress put in place in 2011.

But Mick Mulvaney, the White House budget director, said the plan would bring the Pentagon’s budget to $603 billion in total, just 3 percent more than the $584 billion the agency spent in the most recent fiscal year, which ended on Sept. 30, 2016.

The rise would be slightly higher than the country’s current 2.5 percent rate of inflation.

Since war production is bound to be destroyed, it is inflationary. This can reduce the real value of US debt.

What keeps the dollar from falling despite the US trade deficit ? One reason is the oil trade being in dollars since about 1945. Another major reason is that everybody (China) holds massive amounts of dollars, such that starting selling them in significant quantities would make reserves lose a lot of their value. What made this possible ? The US trade deficit.

The debt made it easier to quit the inflationary decades of the postwar world, when salaries were getting equalized and home ownership was made possible since real interest rates were low. These were hiked up in 1979, a nice move that pressured the indebted Third world into exporting their raw materials cheap. It also triggered austerity policies in OECD countries. Inflation was now out of the question if currencies were to be kept strong. Unemployment, boosting profits by keeping wages down, was to be accepted. Financial deregulation allowed leveraging and securitizing loans, keeping social tensions down.

Now the level of debt may be such that markets fear paying it up can limit public spendings too much.

Erratums.

The abundance of dollars around the world came at first from US loans to Europe and elsewhere (used to buy US goods and materials) and then from the rise of the eurodollar market. The invoicing currency for most international transactions is the dollar, so I still think the US trade deficit may have contributed to its survival so far.

Second correction : net real income in the sixties was not equalized as consumer price indices grew faster for the poorer and progressive taxation was in fact regressive in the inflationary context.