GE Bet on Fossil Fuels, Lost Nearly $200B in Misjudging Renewable Energy Transition

June 6th, 2019

Via: Electrek:

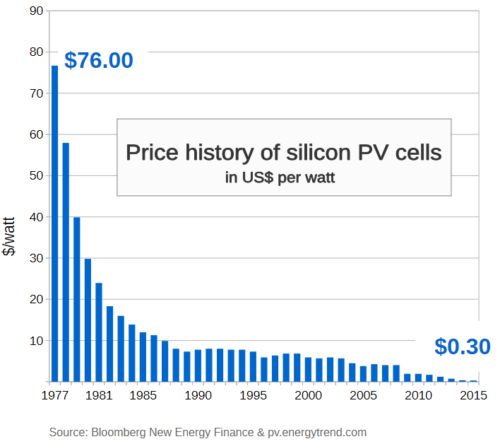

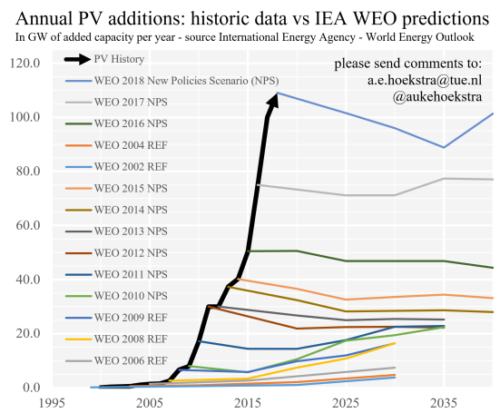

General Electric’s profitability collapse over the past few years can be largely attributed to the company’s inability to judge the accelerating pace of the global energy transition away from fossil fuels and toward renewables, a new study claims.

The analysis comes from the Institute for Energy Economics and Financial Analysis (IEEFA), which says that “GE made a massive bet on the future of natural gas and thermal coal, and lost,” concluding:

GE destroyed an almost unprecedented US$193 billion (bn)1 or 74% of its market capitalization over 2016-2018.

IEEFA acknowledges a number of “other management missteps,” but claims that “this value destruction was driven in large measure by the collapse of the new thermal power construction market globally—a collapse which caught GE entirely by surprise.”

Years ago Hugo Salinas Price penned an article in which he stated, the world doesn’t have a monetary system, it has a monetary process.

He first described a system as having check valves, governors – essentially self regulating. Maybe a steam engine was the example. Then he described the existing Keynesian monetary model as a process, with the dynamics of an explosion. Inflation would be forced to expand, until it couldn’t. Then it would rapidly collapse on itself.

GE, Boeing et al must be loosing vital stability. Excluding any type of nationalization, massive bail-outs seem unavoidable. Could that be the neutron trigger for hyperinflation?